Exactly how will an SR22 influence the cost of my insurance coverage? This takes place since motorists who are called for to have an SR22 are considered risky by insurance policy companies - department of motor vehicles.

It is necessary to keep in mind that you will certainly be accountable for the expense of your deductible if you are entailed in a mishap so constantly select a deductible that you can afford. Another method to decrease the costs cost is to think about the sort of lorry you drive (sr22 coverage). Luxury and also cars have a tendency to be a lot more pricey than sedans as well as various other cars with high security ratings.

Maintain in mind that some insurer offer particular price cuts on costs so speak with your agent and figure out of what you may qualify.

"Individuals who are called for to have this evidence are vehicle drivers that have some sentence or infraction with their state," claims Teresa Scharn, vice president of individual lines product development at Nationwide. "They might have a DRUNK DRIVING, they may have been convicted of reckless driving, [or] they might have been convicted of driving without insurance coverage." Reinstating or keeping your vehicle driver's license is contingent on submitting an SR-22.

Typically, you'll require an SR-22 kind in the following situations: You've been founded guilty for driving intoxicated (DUI) or driving while intoxicated (DWI)You remained in a crash you caused, while driving without insurance policy, You drove while your permit was put on hold or withdrawed, You have actually obtained way too many driving tickets in a brief period of time, You didn't pay court-ordered kid assistance, Keep in mind that not all states call for an SR-22, as well as some require an FR-22 (a comparable kind requiring you to carry even more responsibility coverage than the state minimum) for certain offenses - sr22.

Examine This Report on Sr22 Insurance: Cost & Cheap Sr-22 Insurance Quotes - 101

If an individual does not restore the SR-22, "then the insurance company is needed to inform the state they have actually failed to fulfill the SR-22 filing requirement, indicating they're driving without insurance policy," states Scharn - coverage. The expense of an SR-22 will differ by state, but you 'd typically be billed $25 by your state DMV.

What to Do When Your SR-22 Ends, So you've been driving safely and also paying your insurance costs promptly for three years (or whatever the SR-22 duration is for your state). "When you meet the moment demand, your SR-22 standing is raised," Chen says. From below, you can allow your automobile insurance firm recognize the SR-22 kind isn't required, because or else they'll continue sending it to the DMV."After 3 years, normally a few of those sentences diminish your driving history, as well as your rates tend to go down if you haven't had any even more accidents or violations," claims Scharn.

Many insurer will reduce you a much better bargain after you've shown a great driving history 3 to 5 years after the infraction - car insurance.

underinsured sr-22 sr-22 sr22 coverage credit score

underinsured sr-22 sr-22 sr22 coverage credit score

At United Car Insurance, we recognize that being told you need an SR-22 can feel demanding, confusing and also like you are the only one who requires this additional certification (sr22 insurance). The good news is for you, we can assist with every one of those issues and you must recognize that needing an SR-22 is more common than you think.

Liable Crashes, Depending on the intensity of a crash, if you have been found at mistake for a collision, you might likewise be bought by the courts to maintain an SR-22 for a collection period of time. Several Infractions, Those who acquire numerous smaller sized website traffic infractions in a brief time period might need to submit an SR22.

Getting My Frequently Asked Questions - Insurance Requirements - Nh.gov To Work

Just How Does SR-22 Insurance coverage function? You might have problems if your firm is not licensed in the state asking for an SR-22 certificate - insure.

Staying in a different state does not imply your SR-22 requirements disappear. If your insurance firm is not certified in the state asking for the SR-22, you will certainly need to directly send the SR-22 form keeping that state's DMV.If the procedure is overwhelming, speak to the state's Division of Motor Autos or your representative for aid on your state's needs - liability insurance.

SR22 Insurance Coverage Expenses, Exactly how a lot an SR-22 declaring expenses differs by state - department of motor vehicles. Driver's generally pay around a $25 declaring charge for filing SR-22 insurance.

Meeting your state's needs must be a concern, but you want to locate a quote with a plan that is budget-friendly. Will an SR-22 policy influence my insurance policy cost?

Always be planned for higher coverage prices after the declaring (deductibles). How to Lower Car Insurance Coverage Fees After an SR-22 policy, Your automobile insurance policy costs are bound to increase complying with an SR-22 demand as well as you're going to wish to find a method to reduce them. While they might never ever be as low as they were pre-SR-22, there are still some ways to make them suit your budget plan much better.

Sr22 Insurance - What You Need To Know - David Pope for Dummies

insure insurance group department of motor vehicles division of motor vehicles sr-22 insurance

insure insurance group department of motor vehicles division of motor vehicles sr-22 insurance

Your deductible is just how much you promise to pay in case of a case. The higher your deductible is, the much less your insurance policy costs will be. insurance. When you concur to pay more expense, your insurance firm will need to pay out less following a claim. It is necessary to keep in mind that as soon as you set your deductibles at a particular quantity, you require to make certain that you can really pay it adhering to a crash.

High-powered, luxury lorries are extra costly to guarantee than your daily car. More recent designs additionally tend to be a lot more expensive to cover than decades-old automobiles. It's useful to search and also sell your lorry for one that's a number of years of ages with great safety and security rankings. You will show up to be less of an insurability danger to your insurance provider.

If you are still displeased with your insurance costs, ask your insurance coverage agent concerning any type of price cuts you are eligible for. Representatives are well informed of the fundamentals of all type of discounts you can receive. Terminating or Eliminating Your SR-22 Protection, Even if you are particular your SR-22 duration is up, calling your states Department of Electric motor Autos or DMV confirming that is an excellent idea.

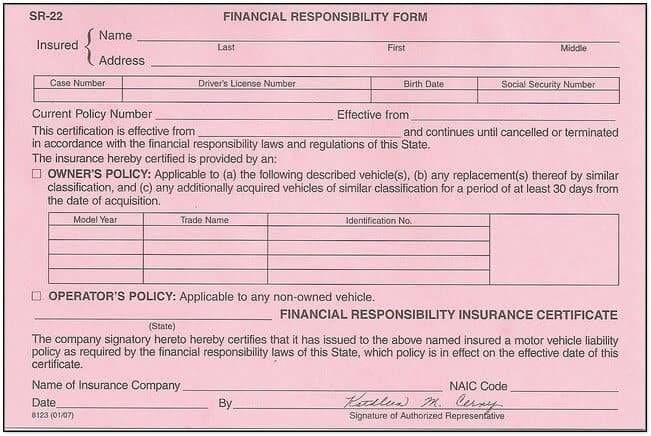

Bring only the state minimum insurance coverage will typically not suffice when you need an FR-44. This, in turn, will elevate your auto insurance rates (deductibles). An FR-44 certification is needed for three years generally, and also it likewise can not be terminated before the expiry day. SR-22 Often Asked Inquiries, Exist various kinds of SR-22s? There are 3 selections when buying an SR-22 certificate from your insurance firm, Owner, Driver, and Owner-Operator.

Driver - An Operator's SR22 Form is for chauffeurs who obtain or rent out a car rather than owning one. This may likewise be paired with non-owner SR-22 insurance coverage and can provide a less costly alternative if it's hard covering the expense of an SR-22. Operator-Owner - The Operator-Owner's SR22 Form is planned for chauffeurs that both own an automobile but occasionally, rental fee or borrow an additional automobile.

Get This Report on Sr-22 (Insurance) - Wikipedia

sr-22 insurance insurance companies vehicle insurance insurance coverage insure

sr-22 insurance insurance companies vehicle insurance insurance coverage insure

You additionally can not only purchase an SR-22 certification (driver's license). It goes together with your car insurance plan. Exactly How Can I Find The Most Affordable SR22 Insurance Coverage Near Me? The most effective method to locate inexpensive SR22 insurance near you is by searching and also obtaining quotes. This is crucial when you are obtaining any kind of insurance coverage yet particularly crucial for SR22s.

National insurer are not anxious to provide insurance coverage for someone who needs SR22 insurance. You might have much better good luck with regional companies as they frequently will cover risky motorists, which you will certainly be considered with your SR22 requirement. Make certain to get SR22 quotes from every insurance coverage firm you discover and analyze all the SR22 plans offered on the marketplace (underinsured).

Does SR-22 Insurance Policy Cover Any Kind Of Cars And Truck I Drive? Yes, your SR22 insurance policy will cover any kind of car you drive so long as you have owner-operator SR22 insurance coverage. An owner-operator SR22 certificate is a type of SR22 type that enables you to drive any lorry, despite who possesses it, as well as still be identified as an insured chauffeur with a valid SR22. insurance coverage.

Proprietor SR22 insurance policy is an SR22 type that just permits you to drive cars that you own. Non-owner SR22 insurance policy is the least expensive choice however is just for individuals who do not own a vehicle yet they frequently drive, whether it be from leasing or borrowing another person's automobile - credit score. It depends upon what your automobile possession condition is when it involves whether your SR22 will certainly rollover to automobiles you drive.

DUI sentences are one of the most typical reasons a vehicle driver would certainly require SR22 insurance. This can include points like reckless driving and also driving without insurance coverage.

The smart Trick of Sr-22 Car / Auto Insurance Quotes In Arizona & Indiana That Nobody is Talking About

They will file your SR22 for you with the state. If your insurer does not offer SR22 certifications, you will certainly need to discover a company that does as well as acquisition insurance protection via them to submit the SR22 kind successfully. Bear in mind that filing an SR22 type will not be the only thing needed of you adhering to a DRUNK DRIVING.

liability insurance insurance companies credit score sr22 coverage credit score

liability insurance insurance companies credit score sr22 coverage credit score

An SR22 certification is frequently the primary step. What's The Distinction Between Responsibility Insurance As Well As SR22 Insurance Policy? It's tough to compare Responsibility insurance and SR22 insurance coverage as one does not actually offer you with protection. SR22 insurance is a certification that proves to your state you carry the proper quantity of obligation insurance policy protection to legitimately be considered a motorist.

Your cars and truck insurance provider will certainly submit the proper SR22 paperwork and submit it with your state's Division of Motor Automobiles or DMV. Obtaining this SR22 certificate does not supply you with insurance coverage. An SR22 just informs the state that you have cars and truck insurance coverage and also can pay for problems must you cause a collision - credit score.

There are two kinds of car insurance policy: liability insurance coverage as well as full coverage. Liability insurance only supplies you with the insurance required by the state. Full insurance coverage vehicle insurance coverage expands protection by including collision and also comprehensive protection on top of obligation insurance coverage.

By purchasing a minimum of among the outlined insurance plan, you can obtain SR22 insurance coverage. The insurances are not similar, yet they do connect to each other. Are SR22 Insurance Coverage And SR-22 Certifications The Same? Yes, the only way SR22 insurance and SR22 certifications vary are their names. These terms can be made use of mutually when going over SR22 kinds.

The Facts About Protect Yourself With Sr22 Liability Insurance From Breathe Easy Revealed

Referring to it as an SR22 certificate is much closer to its actual function. An SR22 functions as a certification of monetary duty that confirms to the state that you are meeting the insurance requirements mandated for all chauffeurs. SR22 insurance policy likely obtained its name because of the fact that the SR22 type can only be filed through your automobile Find more info insurance policy company, as well as functions as proof that you are carrying the proper insurance coverage.